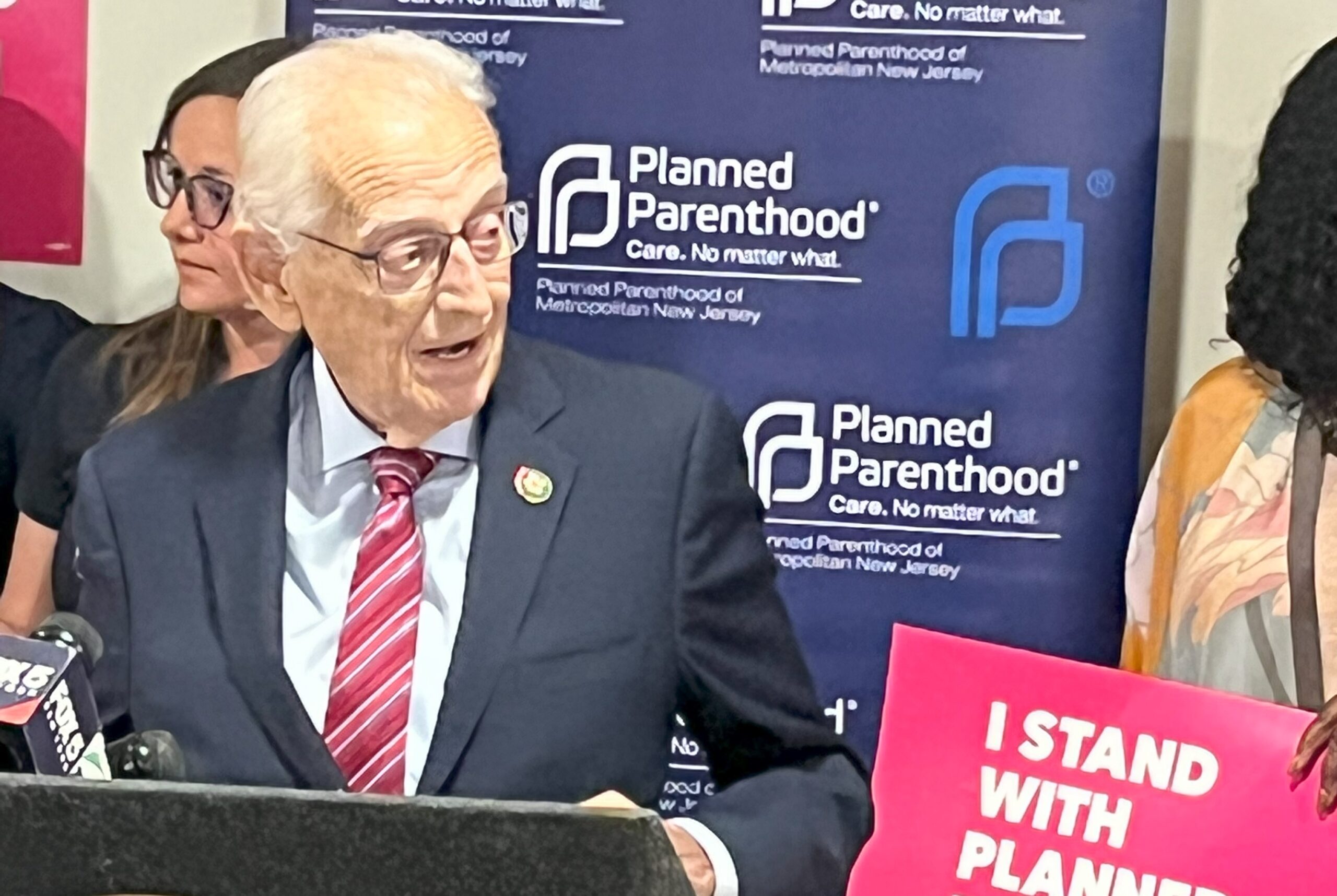

In a recent development, Representative Bill Pascrell has drawn attention to a potential threat to the foundation of American tax law posed by the Moore case. As reported by Insider NJ, Pascrell has raised concerns about the implications of this case and its potential impact on the integrity of the US tax system.

The Moore case revolves around a dispute between the Internal Revenue Service (IRS) and a taxpayer, John Moore. The crux of the matter lies in Moore’s refusal to pay taxes based on his belief that the income tax system is unconstitutional. While such arguments have been made before, this particular case has garnered significant attention due to its potential ramifications.

Representative Pascrell, a member of the House Ways and Means Committee, has expressed his concerns about the Moore case and its potential to undermine the American tax law foundation. He argues that if Moore’s arguments gain traction, it could lead to a dangerous erosion of public trust in the tax system and jeopardize the government’s ability to collect revenue efficiently.

The foundation of American tax law is built on the principle of voluntary compliance, where citizens willingly fulfill their tax obligations for the greater good of society. This principle relies heavily on public trust in the fairness and legitimacy of the tax system. If individuals start challenging the constitutionality of income taxes and refuse to pay, it could set a dangerous precedent that undermines the entire system.

Pascrell emphasizes that the Moore case is not just about one individual’s refusal to pay taxes but has broader implications for the American tax system as a whole. He warns that if Moore’s arguments gain traction, it could embolden others to follow suit, leading to a significant loss of revenue for the government.

Furthermore, Pascrell highlights that the potential consequences extend beyond revenue loss. The government relies on tax revenue to fund essential services such as healthcare, education, infrastructure, and national defense. A significant reduction in tax revenue could severely impact these sectors, affecting the well-being and security of American citizens.

To address these concerns, Pascrell stresses the importance of upholding the integrity of the tax system and ensuring that all citizens fulfill their tax obligations. He calls for increased public education and awareness about the benefits of taxation and the potential consequences of non-compliance. Additionally, Pascrell advocates for robust legal defenses against challenges to the constitutionality of income taxes to protect the foundation of American tax law.

The Moore case serves as a reminder that the American tax system, like any other, relies on the cooperation and trust of its citizens. It is crucial to recognize the potential threat posed by challenges to its foundation and take proactive measures to safeguard its integrity. As this case unfolds, it will be essential to closely monitor its implications and work towards maintaining a strong and reliable tax system that supports the needs of the nation.