Senator Bob Menendez has recently called for the progression of the tax treaty between the United States and Chile. The treaty, which was signed in 2010, aims to prevent double taxation and promote economic cooperation between the two countries.

Double taxation occurs when a person or company is taxed twice on the same income by two different countries. This can happen when a person or company earns income in one country but is also subject to taxation in another country due to their citizenship or residency status.

The tax treaty between the United States and Chile helps to prevent this by establishing rules for how income is taxed and by providing relief from double taxation. It also includes provisions for the exchange of information between the two countries to help prevent tax evasion and promote transparency.

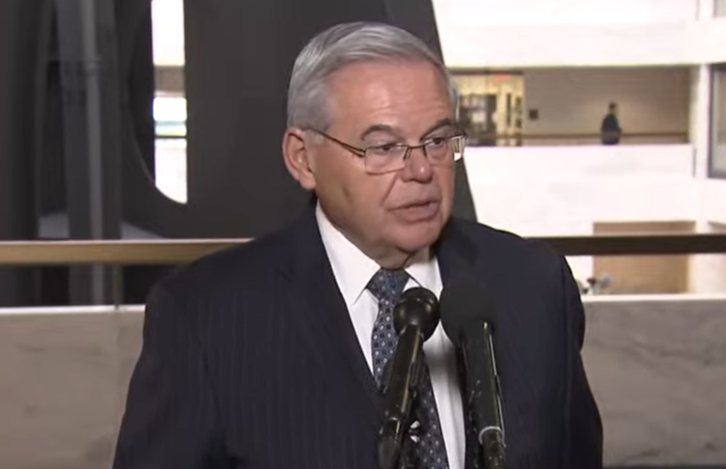

Senator Menendez, who is the ranking member of the Senate Foreign Relations Committee, has been a strong advocate for the tax treaty with Chile. He believes that it is an important tool for promoting economic growth and strengthening ties between the United States and Chile.

In a statement, Senator Menendez said, “The U.S.-Chile tax treaty is a critical tool for promoting economic growth and deepening our relationship with one of our closest partners in the Western Hemisphere. I urge the Administration to prioritize its ratification so that we can continue to build on the successes of this important agreement.”

The tax treaty with Chile has already been ratified by both countries, but it has not yet been fully implemented. In order for it to take effect, it must be approved by the U.S. Senate.

The Senate Foreign Relations Committee has already held a hearing on the treaty, and Senator Menendez has indicated that he will work to move it forward for a vote in the full Senate.

If approved, the tax treaty with Chile will provide important benefits for businesses and individuals in both countries. It will help to reduce the tax burden on those who earn income in both countries and promote greater economic cooperation between the United States and Chile.

Overall, the progression of the tax treaty with Chile is an important step towards strengthening the relationship between the United States and one of its closest partners in the Western Hemisphere. It is a testament to the importance of international cooperation in promoting economic growth and prosperity for all.