Shahid Javed, 39, of Old Bridge, New Jersey, and Wilfredo Topacio, 64, of Woodbridge, New Jersey, were charged in an indictment with first-degree conspiracy, second-degree theft by deception, two counts of second-degree securities fraud, three counts of misconduct by a corporate official, three counts of second-degree impersonation, and two counts of first-degree money laundering in connection with the alleged fraud scheme. Javed is also charged in a separate count with second-degree passing a bad check to an investor during the alleged scheme. The indictment alleges the scheme began in or about March 2018 and continued through in or about April 2023.

As alleged in the Indictment, Javed and Topacio fraudulently obtained over $6.7 million from investors by creating the false impression that invested funds were being used by legitimate business ventures to purchase and sell fuel products for large profits and guaranteed returns. The alleged scheme included defrauding these investors into purchasing $1.1 million in investment contracts with Prime Petroleum, LLC (“Prime Petroleum”) and $5.6 million in investment contracts with Petro Traders Group, LLC (“Petro Traders”), two purportedly legitimate businesses generating substantial profits and guaranteed returns from fuel-product investments. The defendants, however, allegedly operated these entities as sham companies and diverted investor funds for their own benefit, including, among other things, purchasing expensive vehicles, making payments to friends and family, paying off prior business debts, and paying for other personal expenses.

Javed and Topacio also allegedly laundered the funds through bank accounts and corporate entities they controlled to pay the investors in excess of $500,000 in purported investment returns with the investors’ money to promote the alleged deception that their investments actually yielded returns.

“Investment-fraud schemes prey on vulnerable victims with empty promises of huge profits and guaranteed returns,” said Attorney General Platkin. “These defendants allegedly worked together to orchestrate a multi-faceted investment-fraud scheme that took advantage of New Jersey investors for several years. The time has come for them to be held accountable.”

“These defendants allegedly took advantage of investors by duping them into investing millions of dollars into sham companies and then diverted invested money to line their own pockets and to pay other personal expenses,” said Legal Chief Pablo Quiñones of the Office of Securities Fraud and Financial Crimes Prosecutions (OSFFCP). “Cases like this one are a top priority for the Division of Criminal Justice, and we will continue to relentlessly ensure bad actors are brought to justice.”

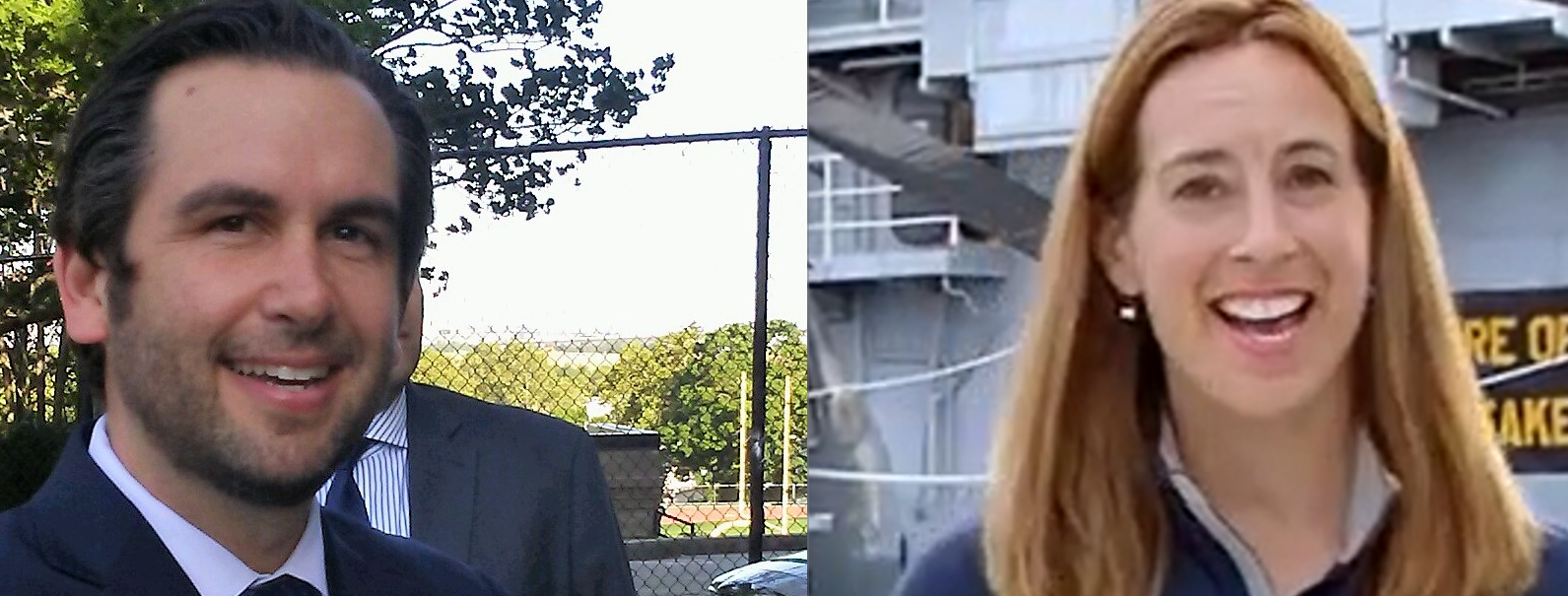

Deputy Attorney General Conner Ouellette within the OSFFCP is handling this matter, under the supervision of Deputy Bureau Chief Adam Heck and Deputy Legal Chief Brendan Stewart.

The investigation was conducted by DCJ detectives, investigators, and analysts dedicated to investigating complex financial crimes, including Detective Nicholas Wiemken, Civil Investigator Gina Lemanowicz-Pusloski, and Special Investigator Sean McCarthy, under the supervision of Lt. Cheryl Smith. The OSFFCP expresses its appreciation to the Woodbridge Police Department for its assistance in the investigation.

The investigation of other individuals involved in the charged scheme as well as other potential victims remains ongoing. Anyone with pertinent information is asked to report the information via DCJ’s tip line at (800) 277-2427 or OSFFCP’s complaint email at [email protected].

As is the case with all criminal defendants, the charges in the indictment are merely accusations and the defendants are presumed innocent until proven guilty.

Defense attorneys: Unknown

Two Middlesex County men have been indicted in a $6.7 million fuel investment fraud scheme, according to Insider NJ. The two men, who have not been named in the article, are facing charges of conspiracy to commit wire fraud and securities fraud.

The scheme allegedly involved the men convincing investors to put money into a fuel investment program that promised high returns. However, instead of investing the money as promised, the men allegedly used it for personal expenses and to pay off earlier investors in a classic Ponzi scheme.

According to the indictment, the men used false and misleading statements to lure investors into the scheme, promising guaranteed returns and downplaying the risks involved. They also allegedly misrepresented their own credentials and experience in the fuel investment industry.

The indictment comes after an investigation by federal authorities, who uncovered evidence of the fraud scheme and brought charges against the two men. If convicted, they could face significant prison time and fines.

Investors who believe they may have been victims of this scheme are encouraged to contact the authorities and seek legal counsel. It is important for investors to thoroughly research any investment opportunity before committing funds and to be wary of promises of guaranteed returns or high profits with little risk.

This case serves as a reminder of the importance of due diligence when investing money and the potential consequences of falling victim to investment fraud. It also highlights the need for regulatory oversight and enforcement to protect investors from fraudulent schemes.