It was during an Andy Kim town hall about 10 days ago when an audience member offered an intriguing way to fight the Trump Administration.

Don’t pay federal taxes.

Kim laughed a bit with the audience but eventually said he didn’t think that was a good idea.

Clearly, the senator hasn’t been talking to Ravi Bhalla and Katie Brennan, two Democratic Assembly candidates in Hudson County’s 32nd District.

Brennan and Bhalla said Monday that the state of New Jersey should do precisely that. In a release, the candidates said that

“The state should withhold tax payments to the federal government, dollar-for-dollar, in response to any illegal (federal) funding cuts.”

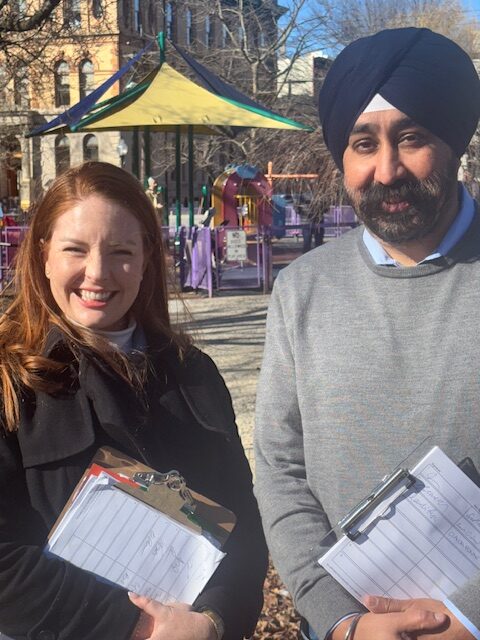

Brennan and Bhalla are two of six Democrats seeking two Assembly nominations in a district covering Hoboken and parts of Jersey City. Also running is a team associated with gubernatorial candidate Steve Fulop and one backed by the Hudson County Democratic organization.

Brennan and Bhalla, the mayor of Hoboken, say they are the team that is “running independent of any party bosses or political machine.”

And in this release , Brennan and Bhalla say they are also the candidates most willing to stand up to Donald Trump. Hence, the idea to withhold tax money.

“New Jersey sends $4,300 more in taxes per person to the federal government than the state receives back, second to only Massachusetts, according to the Rockefeller Institute of Government,” their release said.

The fact New Jersey gets less money back from Washington than it sends is not news. It has been true for decades and candidates from both parties routinely condemn the state of affairs.

The problem in a nutshell is that New Jersey incomes are among the highest in the nation, so it is logical that the state sends more income tax money to D.C. than most other states. And because the state has fewer low income residents – on a percentage basis compared to less-affluent states – it doesn’t get as much federal social spending as other states do.

In this case, of course, Brennan and Bhalla are not talking about math – but politics. They say if leaders are not fighting hard against Trump, they should get out of the way.

This argument is not unique to Hudson County. It is raging in progressive circles all over the nation.

Democrats know full well what Trump is doing, but just for the record, the candidates offered a scorecard of sorts.

“Over the last week, Trump has openly declared that he’s ‘not joking’ about running for a third term despite constitutional limits. He fired two career prosecutors without cause, including one investigating one of his donors. He shook down multiple Big Law firms for over a hundred million dollars in free legal work and coerced them into dropping clients suing the federal government. He withheld federal funds from Columbia University unless they agreed to restrict student speech and the University of Pennsylvania for supposed violations of a new transgender policy that took place before the policy was put in place. And he signed an executive order to suppress millions of votes, take control of administering elections away from states, and give Elon Musk power to review states’ voter registration records.”

Said Brennan:

“The silver lining here is that almost all of Trump’s power was given to him by people who didn’t put up a fight, so he’s really a paper tiger. We need to resist as hard as we can, with all the leverage we have. It’s the right thing to do, it’s what people want, and it’s a winning strategy. We have no excuses.”

As the race for the LD-32 legislative seats heats up, candidates are taking a strong stance against paying taxes to President Trump. In a recent debate, candidates from both parties made it clear that they believe Trump’s tax policies are harmful to the residents of LD-32 and are committed to fighting against them.

One of the key issues that candidates are focusing on is the recent tax cuts passed by the Trump administration. These tax cuts primarily benefit the wealthy and corporations, while leaving middle and working-class families struggling to make ends meet. Candidates argue that these tax cuts are exacerbating income inequality and widening the wealth gap in America.

In addition to the tax cuts, candidates are also concerned about Trump’s proposed budget cuts to social programs like Medicaid, Medicare, and Social Security. These cuts would have a devastating impact on the most vulnerable members of society, including seniors, children, and people with disabilities. Candidates are vowing to protect these essential programs and ensure that all residents of LD-32 have access to the healthcare and support they need.

Candidates are also speaking out against Trump’s efforts to roll back environmental regulations and dismantle the Environmental Protection Agency. They argue that these actions will have serious consequences for the health and well-being of LD-32 residents, as well as the future of our planet. Candidates are pledging to fight for clean air, clean water, and a sustainable future for all.

Overall, candidates in LD-32 are united in their opposition to President Trump’s tax policies and are committed to advocating for fair and equitable taxation that benefits all residents of the district. As the election approaches, voters will have the opportunity to choose candidates who will stand up for their interests and fight against harmful policies coming from Washington.