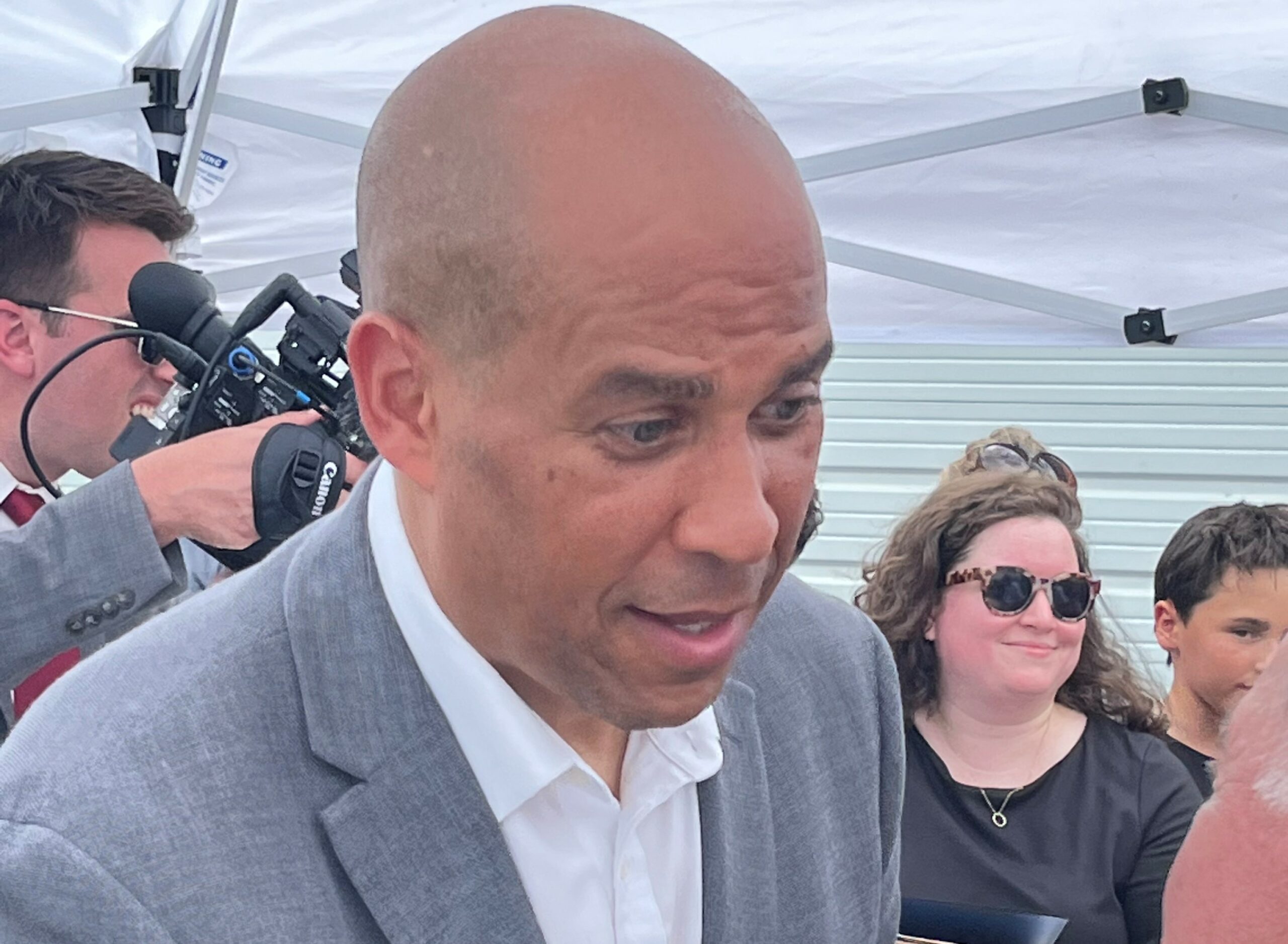

Booker Applauds Proposed Tax Deal as a Significant Progress, States Insider NJ

In a recent development, Senator Cory Booker has expressed his support for the proposed tax deal, hailing it as a significant step forward for the American people. According to Insider NJ, Booker believes that this deal has the potential to address some of the pressing economic challenges faced by the nation and provide relief to millions of Americans.

The proposed tax deal aims to bring about substantial changes to the current tax structure, with a focus on benefiting middle-class families and individuals. Booker, known for his advocacy for economic equality and social justice, sees this deal as a positive move towards creating a fairer and more inclusive society.

One of the key aspects of the proposed tax deal is its emphasis on providing tax relief to working families. By expanding tax credits such as the Child Tax Credit and Earned Income Tax Credit, the deal aims to put more money into the pockets of those who need it most. This, in turn, can help alleviate financial burdens and improve the overall well-being of families across the country.

Booker also commends the proposed tax deal for its focus on addressing climate change and promoting clean energy initiatives. As an advocate for environmental sustainability, he believes that investing in renewable energy sources and incentivizing green technologies is crucial for both economic growth and combating climate change. The tax deal includes provisions that encourage the adoption of clean energy solutions, which aligns with Booker’s vision for a greener future.

Furthermore, the proposed tax deal aims to address income inequality by raising taxes on corporations and high-income individuals. Booker has long been a vocal proponent of closing the wealth gap and ensuring that everyone pays their fair share. By implementing a more progressive tax structure, the deal seeks to redistribute wealth and create a more equitable society.

While there may be differing opinions on the specifics of the proposed tax deal, Booker’s support highlights its potential to bring about positive change. He believes that this deal represents a significant step towards building a more just and prosperous nation. However, it is important to note that the deal still needs to go through the legislative process and may undergo modifications before becoming law.

As discussions around the proposed tax deal continue, it is crucial for policymakers to consider the impact on various segments of society. The ultimate goal should be to create a tax system that promotes fairness, economic growth, and social well-being. Booker’s endorsement of the proposed tax deal adds momentum to the ongoing conversation and underscores the importance of finding common ground for the benefit of all Americans.