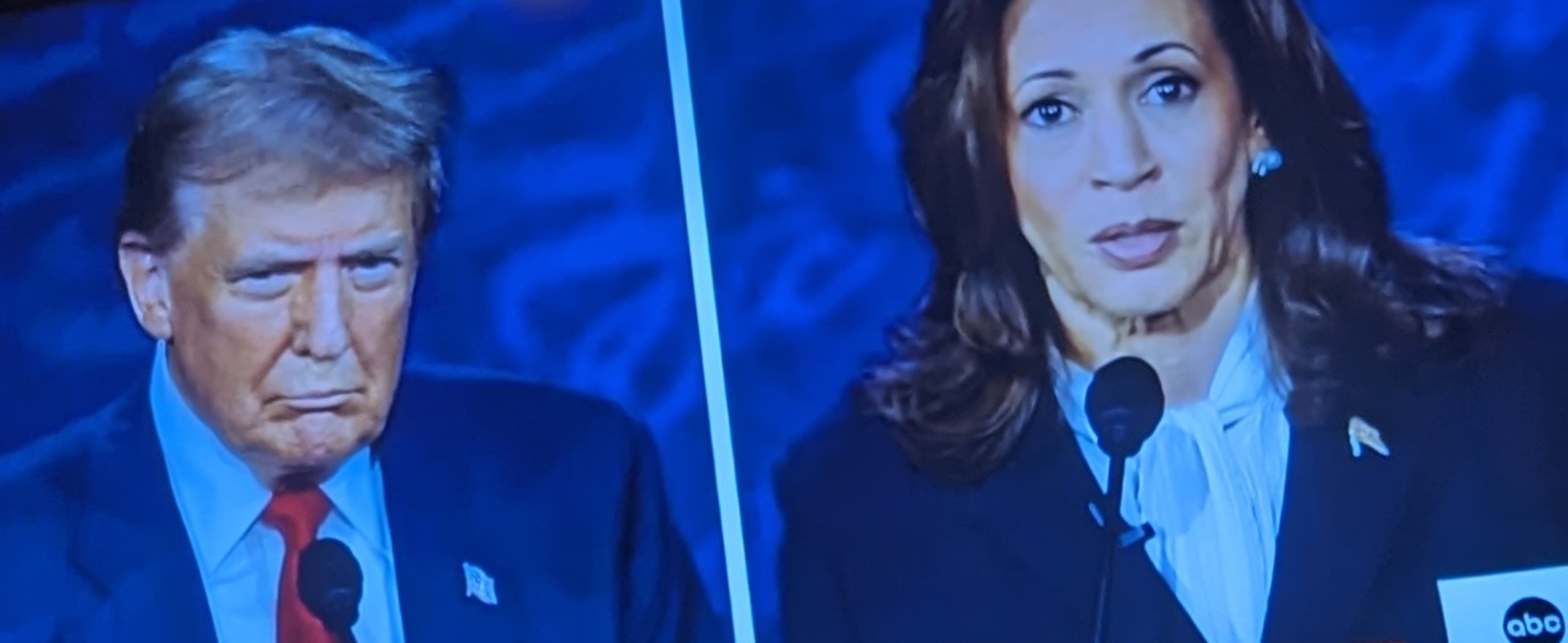

We are not, by and large, policy oriented but we are almost to a person pocketbook oriented. On that score, what Harris and Trump are promising – the “Opportunity Economy” versus the “Best Economy Ever” – resemble white caps on the surface of the ocean. Easy to see but unrevealing of what lies underneath.

And what lies underneath matters. Because most government initiatives rarely outlast a single administration. By contrast, transformative changes to the world’s largest economy tend to be incremental and are most often in response to forces outside any politician’s control. Or, frankly, their imagination.

One exception to the disconnect between short-term politically rooted economic policies and the deep movement of our economy concerns basic plumbing. That is, those structures that comprise the lifeblood of our economy.

For example, the FDIC was created after the Great Depression to buttress banks. It worked. By restoring public confidence that deposits were safe the FDIC solidified the banking sector as a critical financial pipeline for the entire economy. And that piping continues to positively impact our lives some 90 years on. Consider where we would have been without the FDIC in 2008 during the Great Recession, or in 2020 during the pandemic shutdown.

Another fundamental part of our economic plumbing is taxes. No one likes to pay them, but “freedom isn’t free” and neither is Social Security, Medicare, our national defense, our roads, bridges, or railroads, and the countless public goods that we are only vaguely aware of yet routinely rely on virtually every day.

On the federal side that makes the IRS, which collects federal taxes, a key part of the plumbing. We need them because far too many people don’t pay what they owe, leaving the rest of us to cover the shortfall. Besides ultimately reducing the amount of money needed from the rest of us, collecting taxes owed by others also validates our own decision to pay them by demonstrating that we are not idiots for doing so.

Since the IRS collects more money than it spends to collect it, properly resourcing the IRS makes common sense. But common sense too often does not seem to translate into politics or policy.

Until recently, the IRS’ overall budget and collections workforce had been relentlessly cut (by 18% and 31%, respectively) as its responsibilities mushroomed. That changed under Biden when Congress approved a $58 billion increase over 10 years (actually, $80 billion before a claw back by Congress of $21 plus billion).

I am not sure whether the funding that remains is actually an increase. One could argue that most or all of the additional $5.8 billion a year (for 10 years) will do little more than restore the IRS’ capabilities to where they were before the years of cuts.

Regardless, a lot of people don’t file tax returns, including the wealthy. Why? Because the IRS still doesn’t have enough people or bandwidth to adequately police them.

So far this year, the IRS has sent letters to over 125,000 people with incomes (independently reported by employers, brokerage houses, banks, etc. to the IRS) of more than $400,00 that have not filed an income tax return since 2017. To date, about $172 million has been collected from 21,000 of this group, with the likelihood of hundreds of millions of more dollars to come. In 2023, the IRS also targeted people with incomes exceeding $1 million and over $250,000 in tax debts and, to date, has collected another almost $1.1 billion from them.

Looking forward, Treasury Secretary Yellen has suggested that the $58 billion investment in IRS capabilities should yield collections of somewhere between $200 billion and $500 billion over time in taxes owed. Which is, of course, the mere tip of the $700 billion a year tax evasion iceberg.

You would think that there would be bi-partisan agreement that this IRS funding should be continued and supported. And you would be wrong. To my knowledge the candidates have not spoken directly to this aspect of our economic plumbing. But the two parties have.

MAGA wants to massively defund the IRS. Why? Well, they generally refer to the $5.8 billion a year annual funding over 10 years as a “windfall” Unsurprisingly, without any rational explanation.

Instead, they claim that it will allow tens of thousands of new IRS hires, who will then “harass the middle class.” Leaving you to figure out on your own that, in fact, many of these new hires will simply replace the tens of thousands of current IRS employees who will likely retire during the same 10 year period, about half of the new funding will go to upgrading enforcement capabilities (parts of the IRS still use 1960s software), only 17 out of 1,000 taxpayers making $200 thousand or less are now audited, and the IRS has publicly stated that this audit percentage will not change.

Incredibly – as in “not credible” – one MAGA proposal is to actually reduce the IRS Commissioner’s annual salary to $1. That’s right. One hundred pennies per year. Courtesy of Marjorie Taylor Greene, who has emerged as a centrist MAGA voice in the latest debacle; the Trump/Loomer dumpster fire. As opposed to Trump, who lit the match by inviting, and keeping, Loomer in his inner circle because she says likes him.

Leaving one to wonder for whom the “Best Economy Ever” will be the best for.

What about the other side? Biden engineered the law that gave the IRS its initial $80 billion and Harris was the tie breaking vote in the Senate that passed it.

This is not about ideology. It is about truth, the lack of it, and basic blocking and tackling. Both sides are proposing short-term giveaways to attract votes. But Harris also wants to do something that matters much more. She wants to maintain and improve the plumbing. And Trump almost certainly doesn’t.

(Visited 8 times, 8 visits today)

The economic plans proposed by presidential candidates Kamala Harris and Donald Trump have been widely discussed and debated in recent months. However, there is one aspect of their plans that has been largely overlooked by the media and the public: the impact on small businesses.

Small businesses are the backbone of the American economy, accounting for nearly half of all private sector jobs and contributing significantly to economic growth. Yet, when it comes to economic policy, small businesses are often left out of the conversation.

Both Harris and Trump have put forth economic plans that focus on issues such as tax reform, trade policy, and infrastructure spending. While these are important issues that can have a significant impact on the economy as a whole, they do not address the specific needs of small businesses.

For example, Harris has proposed raising taxes on corporations and wealthy individuals to fund programs such as Medicare for All and tuition-free college. While these programs may benefit some small businesses by reducing healthcare costs and increasing access to skilled workers, they could also have a negative impact on small businesses by increasing their tax burden.

On the other hand, Trump’s economic plan includes cutting taxes for businesses and individuals, reducing regulations, and renegotiating trade deals. While these policies may benefit some small businesses by reducing their tax burden and cutting red tape, they could also have negative consequences for small businesses by increasing economic uncertainty and volatility.

In addition to tax and regulatory policies, both candidates’ plans also overlook other important issues facing small businesses, such as access to capital, workforce development, and technology adoption. These are all critical factors that can determine the success or failure of a small business, yet they are often ignored in discussions about economic policy.

It is important for policymakers and the public to consider the impact of economic policies on small businesses, as they play a vital role in driving economic growth and creating jobs. By addressing the specific needs of small businesses in their economic plans, candidates can ensure that their policies will have a positive impact on the economy as a whole.